WEEKLY INVESTMENT STRATEGY REPORT ON 27th MAY, 2024

Vietinbank Securities has published the Weekly Investment Strategy Report on 27th May, 2024 with the executive summary presented below:

- The minutes of the meeting released on May 22nd indicated that Fed officials believe interest rates are already high enough to slow economic growth and inflation. However, they also highlighted concerns about the persistence of inflation, signaling that the Fed might not reduce interest rates soon. This led to the Dow Jones index falling by 201.95 points, or 0.51%, to 39,671.04 points, marking the steepest decline since the beginning of the month. The S&P 500 index dropped by 0.27% to 5,037.01 points, and the Nasdaq index slipped by 0.18% to 16,801.54 points.

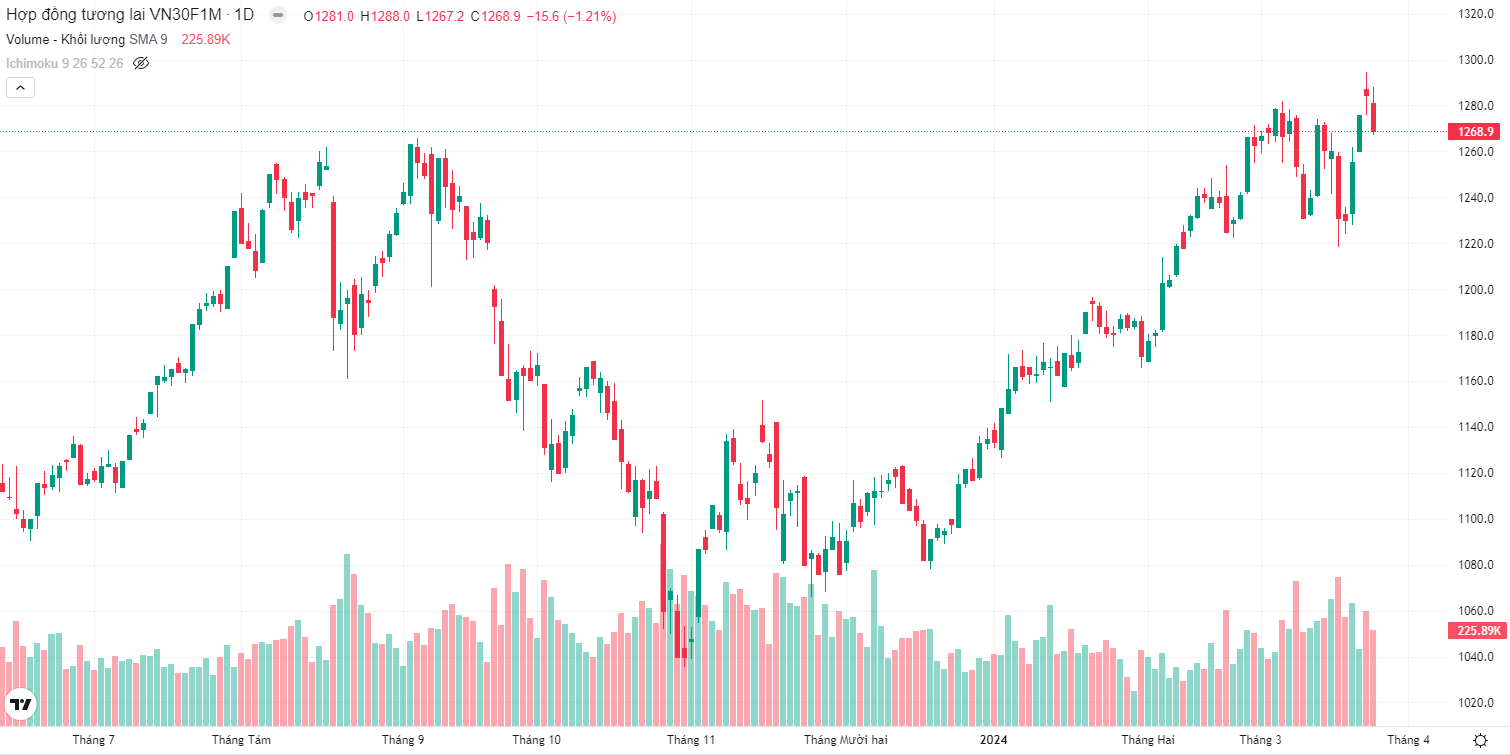

- Over the past week, the VN-Index recorded a decline of 0.88%, ranking among the top 6 worst-performing indices in the monitored basket. Notably, the decline on May 24th saw the highest liquidity in the past two months, significantly boosting average daily trading volume and value compared to the previous week, reaching 1.12 billion shares and 27,714 billion VND, respectively. In terms of sectors, the strongest inflows were observed in insurance stocks (9.70%) and oil and gas stocks (4.22%).

- With the projected cautious approach of cash flow following the strong market decline at the end of last week and the increasing pressure on the USD/VND exchange rate, the market is expected to consolidate within a narrow range of 1,240 – 1,265 points during the week of May 27 – May 31, 2024. Investors are advised to maintain a stock/cash ratio of 60% – 80%

- Investors should be cautious about making new purchases of stocks that have already exhausted their upward potential and are preparing to take profits from this group of stocks. Instead, they should only buy new stocks that still have upward potential and their own growth story. Investors should be cautious about making new purchases of stocks that have already exhausted their upward potential and are preparing to take profits from this group of stocks. Instead, they should only buy new stocks that still have upward potential and their own growth story.

- In the coming weeks, it is expected that the VN-Index will maintain a wide accumulation range in the current point range after statistics indicate that inflation in the US is starting to weaken and domestic exchange rates begin to cool down following the intervention measures by the State Bank of Vietnam (SBV).

- Some of the noteworthy stock groups at this time include:

- Government Infrastructure: HHV, CII, KSB

- Securities: HCM, SHS, VIX, SSI, VND

- Real estate: TCH, DIG, CEO

- Retail: DGW, MWG, MSN

- Steel: HSG, HPG

- Bank: ACB, CTG, VIB, TPB, VPB, VCB, STB

- Textile: TNG, GIL

- Industrialized Real Estate: IDC

- Energy: PC1

- Petrolium: BSR

- Others: PNJ, GEX, DBC, HAX