WEEKLY INVESTMENT STRATEGY REPORT ON 1st JULY, 2024

Vietinbank Securities has published the Weekly Investment Strategy Report on 1st July, 2024 with the executive summary presented below:

- The second revision of U.S. economic growth data released on June 27 showed that the GDP for Q1 increased by 1.4%, higher than the initial 1.3% estimate but still lower than the 3.4% recorded in the previous quarter. This figure aligns with analysts’ expectations, indicating that the U.S. economy shows signs of weakening and has not recovered as positively as hoped. Further inflation data will be needed to predict the Fed’s likelihood of cutting interest rates in the upcoming September meeting.

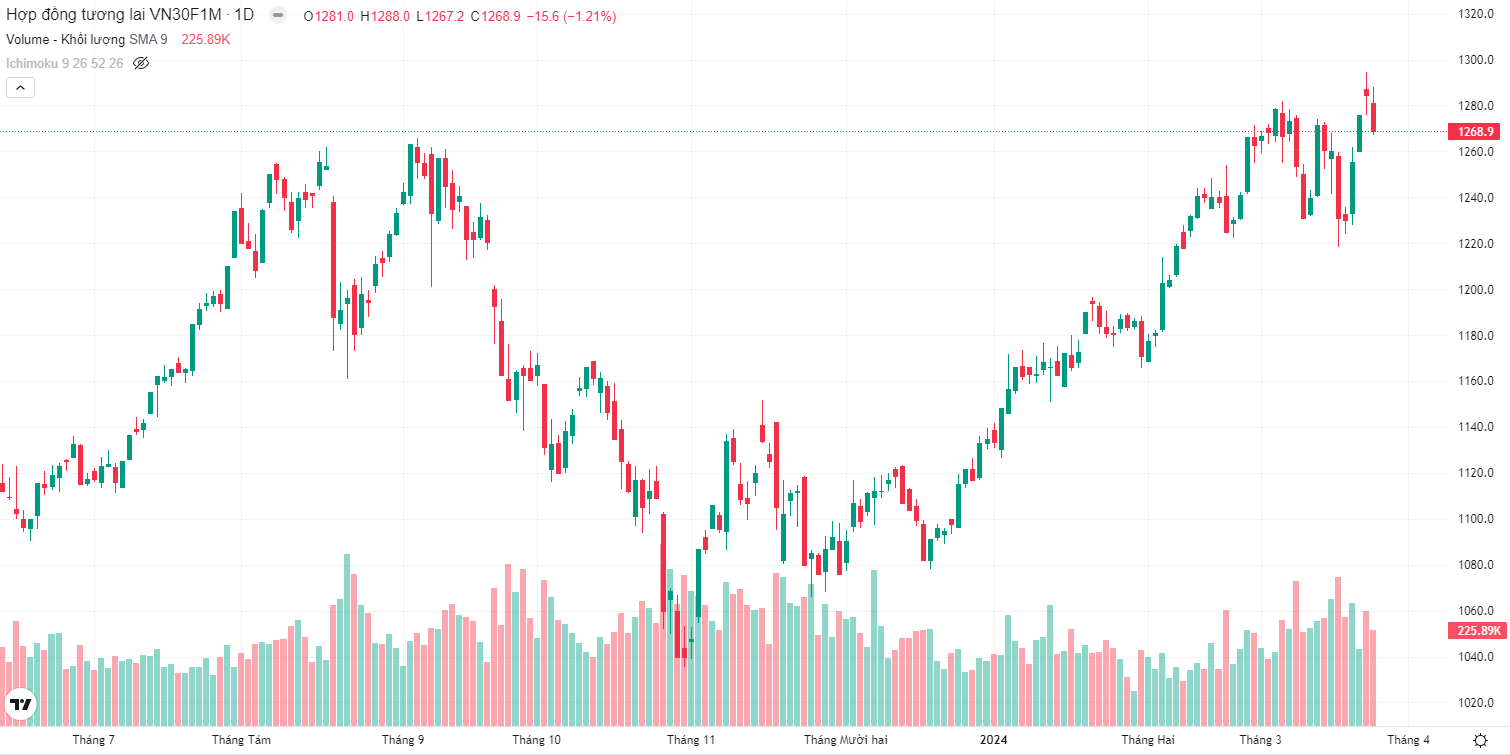

- During the past week, the VN-Index decreased by 2.86%, making it the sharpest drop among the indices monitored. However, a positive signal was noted as the average daily trading volume and value slightly decreased compared to the previous week, reaching 880 million shares and 22,040 billion VND, respectively. In terms of sectors, the most significant outflows were observed in financial services (-4.72%) and construction and materials (-2.7%).

- With the market experiencing the sharpest weekly decline in the past two months, domestic investor sentiment is expected to remain cautious. The VN-Index is projected to fluctuate between 1,230 and 1,255 points during the week of July 1–5, 2024. Investors are advised to reduce a stock-to-cash ratio of 50%.

- Investors should carefully select stocks to participate in and only hold stocks that have good accumulation bases and unique growth stories. Additionally, investors should restructure their portfolios for stocks that are currently at high price levels and facing strong selling pressure.

- If the index continues to face intense selling pressure, it is likely to adjust to the range of 1,180 – 1,200 points.

- Some of the noteworthy stock groups at this time include:

- Short-term trading groups

- Securities: SHS

- Real estate: DIG

- Others: CTR, GEX, VTP, CTD, ANV, AAA, DPM

- Medium-term holding groups

- Energy: PC!

- Petrolium: BSR

- Textile: TNG, GIL, TCM, MSH

- Long-term holding groups

- Steel: HPG, HSG, NKG

- Bank: ACB, MBB, SHB

- Retail: DGW, MWG, MSN

- Industrialized real estate: KBC, IDC, VGC

- Short-term trading groups